News

A Paradigm Shift for the U.S. Dollar

COIN MARKET INSIDER • VOLUME 33 • ISSUE 38

The US dollar has entered an entirely new phase and the consensus seems to indicate that it will enter an extended period of decline.

This has tremendous implications for the tangible asset markets. For much of the past 2-3 years, the main factor that was keeping hard assets from a steep rise was the strong dollar.

The greenback’s worst slump since November has a bevy of strategists and investors saying a turning point is finally at hand for the world’s primary reserve currency.

If they’re right, there will be far-reaching consequences for global economies and financial markets.

The US currency is teetering at the lowest level in more than a year after signs of cooling inflation bolstered bets that the Federal Reserve will soon stop hiking interest rates. Dollar bears are looking even further ahead, to what they say are inevitable rate cuts, something the market consensus sees happening at some point in 2024.

Against a basket of six currencies, the dollar index fell 0.8% to 99.738, after dropping earlier to 99.767, a new 15-month trough. The dollar index was headed for its biggest weekly slide in 2023.

The euro rose 0.9% to $1.1220, after hitting a new 16-month high earlier in the session.

The euro headed for a sixth daily gain, its longest stretch of rises against the dollar this year. Versus the Swiss franc, the dollar plunged to an eight-year low of 0.8583 francs. It last changed hands at 0.8588 francs, down nearly 1%.

Dollar’s Longer-Term Decline

This could be just the beginning of a longer-term decline in the dollar and not just a short-term slump.

The U.S. dollar could soon wipe out all of its post-pandemic gains, Soc Gen strategist warns.

The slide in the U.S. dollar in the last eight months could mean that all of its gains in the wake of the coronavirus pandemic will soon be lost, according to Kit Juckes, a macro strategist at Société Générale who has been a long-time currency analyst.

-

2024 $1 Silver American Eagle PCGS MS70 FDOI “Dont Tread On Me” Label$79.42

2024 $1 Silver American Eagle PCGS MS70 FDOI “Dont Tread On Me” Label$79.42 -

1986 SILVER EAGLE NGC MS70$890.40

1986 SILVER EAGLE NGC MS70$890.40 -

1986 – 2024 P $1 40 Coin-Silver American Eagle Complete Set NGC MS69$2,375.00

1986 – 2024 P $1 40 Coin-Silver American Eagle Complete Set NGC MS69$2,375.00 -

2021(P) $1 SILVER EAGLE NGC MS70 FDOI$49.50

2021(P) $1 SILVER EAGLE NGC MS70 FDOI$49.50 -

2021 W $1 SILVER EAGLE NGC PF70 T1$125.00

2021 W $1 SILVER EAGLE NGC PF70 T1$125.00 -

2021 S $1 SILVER EAGLE NGC PF70 ER T2$129.00

2021 S $1 SILVER EAGLE NGC PF70 ER T2$129.00 -

2022 W $1 Silver American Eagle NGC David Ryder Signed MS70 E.R.$130.00

2022 W $1 Silver American Eagle NGC David Ryder Signed MS70 E.R.$130.00 -

2022 David Ryder Signed $1 Sliver American Eagle NGC PF 70 Early Releases$225.00

2022 David Ryder Signed $1 Sliver American Eagle NGC PF 70 Early Releases$225.00 -

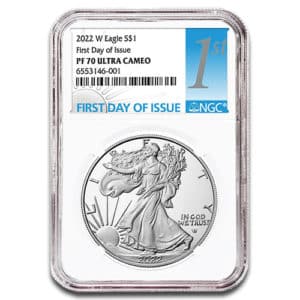

2022 W $1 Silver American Eagle NGC First Day of Issue PF 70 Ultra Cameo$199.00

2022 W $1 Silver American Eagle NGC First Day of Issue PF 70 Ultra Cameo$199.00 -

2022 David Ryder Signed $1 Sliver American Eagle NGC MS70 Early Releases$145.54

2022 David Ryder Signed $1 Sliver American Eagle NGC MS70 Early Releases$145.54